FREQUENTLY ASKED QUESTIONS

FAQ’s

Here you can find the most common questions related to Impact Incentives and the most common answers.

Traceability

-

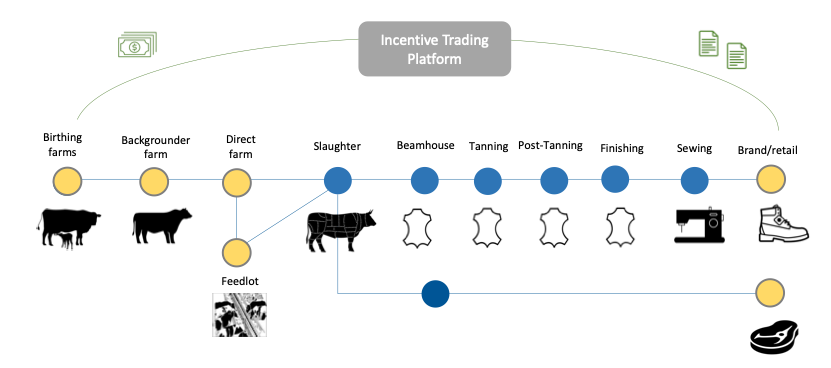

The idea of Impact Incentives came about when Textile Exchange was looking for a solution to help brands address the impacts at the very beginning of their leather supply chains. It was quickly apparent that a chain of custody or traceability solution would not be possible at any scale, given the length, complexity, and opaque nature of the supply chain. A credit trading system made much more sense, as it allowed brands to connect directly to all levels of farms and was also a much more efficient way to transfer financial support to them.

-

Yes and no. Impact Incentives do not provide any link between the brands that are buying them and the farmers selling them. When brands make claims relating to their use of Impact Incentives, they will be about the impact and the farms they have supported but will not relate to the content of their products.

However, a requirement for farms to sell Impact Incentives is that they are engaging in some form of a traceability system. The purpose of this is to drive the supply of sustainable and traceable materials, to eventually set up the conditions for a traceable supply network. We see this as an investment in systems change.

-

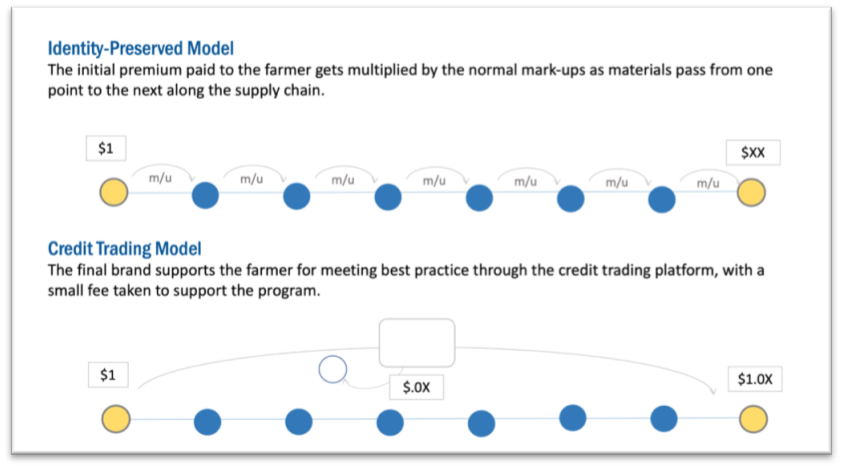

Yes, Impact Incentives can definitely be used with traceability systems. Textile Exchange is talking with brands that are interested in using a chain of custody system to track organic cotton directly from farms through the supply chain and into their products. However, they will use Impact Incentives to deliver financial support directly to the farmers or program partners that are supporting them; this is much more efficient as the premiums being paid by the brands are not eroded by the standard margins that the different supply chain players will take

-

Impact Incentives play a critical role to kickstart the supply and demand for more sustainably produced materials. Whenever a new standard or initiative gets launched, scaling it up is always the challenge because brands do not want to make commitments until they know there is supply. Farmers do not want to go through the expense of changing their practices and becoming certified until they know they have demand. When the supply and demand signals have to work their way through the full supply chain, they can take a long time to connect.

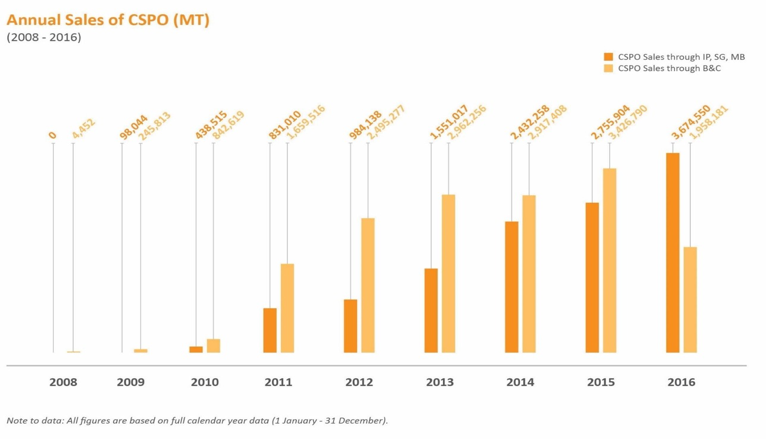

The chart below illustrates how this has worked for the sale of certified sustainable palm oil. As we can see, the majority of the trading for the first eight years was through the book and claim system, which is similar to the Impact Incentives. Over time supply chains began to form the connections needed for physical trading, and by 2016 the more significant share was being traded physically with identity preserved, segregated, and mass balance systems.

-

While the Holy Grail for many is fully traceable supply chains, we simply do not have the luxury of time to work this way. We are in a decade of change, with serious and urgent actions needed at all levels if we are to protect the future of this planet. Impact Incentives will act as a powerful tool to leverage the power of multiple industries and to accelerate change where it is needed most.

-

Our experience with special interest groups is that they ask brands to commit to physically sourcing their products from farms that meet various standards, such as animal welfare, deforestation, etc. Some of these groups have initially been suspicious of the Impact Incentives model as they see it as a way for brands to avoid taking responsibility for their sourcing. However, we talk to them about the power of Impact Incentives to accelerate change at scale, and how they give brands a way to invest in more sustainable practices at the farm end of the supply chain. We have seen a shift in the reaction of the special interest groups we talk with, and we have a number of animal welfare groups publicly endorsing the use of Impact Incentives to address animal welfare.

Impact Incentives vs Credit Trading

-

While Impact Incentives are essentially a sustainability certificate trading system, they have some key distinctions from other systems. The following is a summary of the ways that they differ, and further information can be found at impactincentives.org or by contacting the Impact Alliance.

- Incentive buyers know the identity of the incentive sellers (farms): there is no blind trading, and there is strong transparency.

- All trades are back-to-back: nobody can buy Incentives and hold on to them waiting for a better price, so speculation is eliminated.

- Only downstream companies can buy Impact Incentives: this maintains transparency, avoids mark-ups being added to the incentives as they change hands, and fosters the development of relationships between the two ends of the supply chain.

- Impact Incentives can only be registered by a third party: the third party will confirm that the threshold requirements of the Impact Incentives are met, and that the data being supplied is correct. This maintains the credibility of the system.

- Impact Incentives set common thresholds: this increases their value and flexibility to users at both ends of the supply chain and enables connected action across commodities.

- Impact Partnerships: these give a way for smaller and marginal farmers to receive the support they need to adopt best practices.

- Impact Alliance: by developing and sharing the Impact Incentives system across multiple partners, we can leverage our collective expertise and action to deliver results at scale.

-

The Deforestation/Conversion-Free (DCF) Impact Incentives are based on zero deforestation or conversion, which means that forests and natural landscapes are preserved. With carbon credit schemes, projects estimate the emissions they have prevented by predicting how much deforestation and land clearing would have occurred without them. The reductions are then sold on as credits. This approach receives several criticisms:

- There are concerns about the inherent problem of looking into the future and predicting which trees would and would not have been felled, and of proving additionality – that the project itself made a difference to the outcome.

- There are ethical considerations of tying up resources (e.g., land) in developing countries so that companies in developed nations can continue to emit GHGs.

Impact Incentives do not claim to be carbon offsets. The DCF Incentives do, however, directly support farmers to preserve forests and natural landscapes, which means that carbon stocks are locked into the forests and soils, and biodiversity is protected. The Impact Alliance is working on ways to roughly measure the carbon stocks and biodiversity values of these preserved areas, and the brands and retailers investing in DCF Incentives can talk about the impacts they are supporting.

Brand Strategies

Brands have multiple ways to work with Impact Incentives, and the strategies chosen will depend on the goals and policies of each company. Here is an outline of the questions to consider:

-

Brand will typically choose scopes that match to their own corporate CSR goals, or that help them meet global targets or public commitments.

- Animal welfare (AW)

(maps to the OIE guidelines) - Deforestation/conversion-free (DCF) (supports commitments and targets such as UNFCCC, SDG 13 and 15, Fashion Pact, New York Declaration on Forests, Amsterdam Declaration Partnership, Consumer Goods Forum Zero Net Deforestation Commitment, others)

- Both AW and DCF

- Animal welfare (AW)

-

- Impact Incentives – These will be purchased from farms that have been verified to have met the LIA benchmark for the scopes you have chosen (AW and/or DCF). These incentives give you a clear understanding of what the farms are doing and give the farmers a reward for meeting best practices.

- Impact Partnership Incentives – These will be purchased from programs that are working with farms that are not yet able to meet all of the LIA requirements. The programs will help the farms with trainings, data collection, verification and possibly even investments in equipment as needed. Given programs have up to 3 years to get the farms to meet LIA expectations, the results may not be evident in the timeframe of the pilot, however there will be very robust stories to tell.

- Combination – Ultimately, we would like to see brands buying both Impact Partnership Incentives and Impact Incentives. The former drive change, and the latter sustain it. Ideally, as LIA progresses, we hope to see brands investing in Partner Programs to train the farmers to meet the best practices, and even to commit to supporting the farmers once they ‘graduate’ by buying the Incentives directly from them.

-

- Regions that match your sourcing areas – This is a good way to invest in developing a supply network that you will eventually be able to physically source from. Some brands may have not yet mapped their supply chains to know where their hides come from or have supply chains that involve traders who source from multiple regions.

- Regions that drive the greatest impact – For brands with strong CSR targets, it can make sense to fully decouple the incentive purchases from physical sourcing and focus on areas of high risk. For DCF, the risk areas can also be mapped to areas of high carbon stock and high conservation value (eg: Amazon, Chaco, Cerrado)

- A combination.

-

It is possible to combine the Impact Incentives with a chain-of-custody or tracking system, so that a brand will be sourcing their physical products from the farms or program partners that they are supporting through Impact Incentives. This adds further cost and complexity over simply using the Impact Incentives on their own, but allows for product claims, and is a more efficient and transparent way to directly support farmers than moving a premium through the full supply chain, where each player will take their margin on it.

Impact Incentives: Costs and pricing

-

The answer is truly “it depends”. There are no set prices for Impact Incentives: the prices are a result of supply and demand. Farms or Partner Programs will look at what makes it worth their while to meet the scope requirements or the standard, and brands and retailers will look at what it is worth to them to invest in best practices at the start of the supply chain.

-

Given that prices will be set by supply and demand factors, the Impact Incentives that are in the highest demand (and/or shortest supply) should end up with the highest values. We would expect that the Impact Incentives that deliver the greatest impact (eg: deforestation-free in high risk, high conservation values) would end up being higher value, but this is not necessarily so.

-

Yes. Incentive buyers and sellers can set up longer-term agreements to trade Impact Incentives at an agreed price. This will benefit both sides by reducing risk and uncertainty. The Facilitator can play a useful role in setting up these arrangements.

-

No. One characteristic of the Impact Incentives is that only back-to-back trading is allowed: it is not possible to buy Impact Incentives when prices are low, then sell them when the price is higher. In fact, trading of Impact Incentives by intermediaries is very controlled – we do not want to see profit-taking by the middle of the supply chain; we want the maximum value to go directly to the farm or Partner Program.

Impact Incentives: How to get started

-

Contact the program that is associated with the Impact Incentives you would like to work with (as a buyer or seller):

- Beef – Josefina.Eisele@grsbeef.org

- Cashmere – ImpactIncentives@textileexchange.org

- Cotton – ImpactIncentives@textileexchange.org

- Eggs – j.nuggehalli@globalfoodpartners.com

- Leather – ImpactIncentives@textileexchange.org

- Wool – ImpactIncentives@textileexchange.org